Financial Reports Explained Without Numbers or Math

All business activities fall into two broad categories, subjective and objective.

The subjective group is what most of us think of as business and includes things like leadership, sales, marketing, customer satisfaction, quality and so on. They are subjective because there are infinite approaches to each and only fuzzy definitions of success.

To show what I mean, imagine that you and your sales manager disagree on how sales are going. He feels “good” about sales, you don’t. Who is right is a matter of opinion - unless one of you brings data to support your position, in which case you have crossed over to the objective side.

The objective side of business involves numbers. Numbers are the score, and are as close as we can get to facts. They provide feedback on what you’ve done and, more importantly, they provide guidance for future decisions.

There is a saying often attributed to Edwards Deming that “We cannot manage what we do not measure.” Numbers are the measurement that make management possible.

The corollary of the quote is: “If we don’t manage it, everything that happens to us – good or bad - is an accident.” We might survive by accident, but we cannot thrive, which means we cannot thrive without numbers.

Now don’t panic. As business owners, WE do not have to collect and compile numbers. We don’t even have to know how it’s done, but we do have to understand what numbers tell us.

Three reports answer five questions

Financial numbers are reported in three standard reports: The Income Statement (also known as the Profit and Loss Statement), the Balance Sheet, and the Statement of Cash Flows.

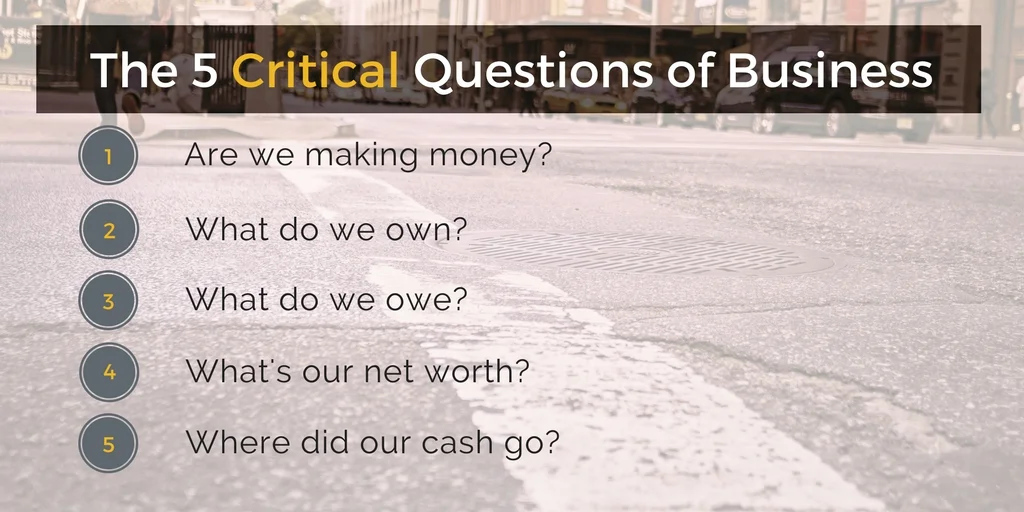

There are three reports because that’s how many it takes to answer the five critical questions of business: “Are we making money?; “What do we own?,” “What do we owe?,” “What's our net worth?” and “Where did our cash go?”

Answers to those five questions tell us (almost) everything we need to know about how our businesses have performed, and, more importantly, give us important insights into managing our businesses for the future.

1. The Income Statement - “Are we making money?"

I have never met a small business owner who hadn’t at least attempted to create an Income Statement. The attempt might be scribbles on a napkin, entries in an Excel spreadsheet, a collection of bank statements showing deposits and withdrawals, or a proper report prepared by our accountants. Regardless of how we do it, we all seem to understand the need to compare income to expense.

I list the Income Statement first because above all else, we must know if we are making money.

A business might survive temporarily on money supplied by the owners or banks, but sustainability ultimately depends on making money. The Income Statement tells us.

“A business might survive temporarily on money supplied by the owners or banks, but sustainability ultimately depends on making money. ”

The Income Statement is a period statement, which means it tells us whether or not we made money over a specific period of time, usually a month or a year.

The Income Statement compares income from sales during a period to expenses for the same period. If a business has more income than expense, it is making money (profit).

If it has more expense than income, it is losing money (a loss). The famous “bottom line” is found on the Income Statement and answers the question: “Did we make money in this period?”

2. The Balance Sheet - “What do we own?” “What do we owe?” and “What’s our net worth?”

Most business owners I’ve met have produced at least the occasional Balance Sheet, usually because a bank asked them to. The Balance Sheet is less intuitive than the Income Statement, but it is not hard to understand.

““If we don’t manage it, everything that happens to us – good or bad - is an accident.””

Unlike the Income Statement that shows what happened over a specific period of time, the Balance Sheet is a “snapshot” report that shows the overall condition of a business as of a particular date.

The report is a list of what a business owns and what it owes. The underlying idea is that everything a business owns, its “assets,” is owed to someone. If the obligation is to a non-owner, such as a bank or a supplier, it is called a liability. If the obligation is to an owner, it is called equity.

Because everything is owed to someone, total assets must always equal the combined total of liabilities and equity, in other words, the two totals must “balance.”

When liabilities are subtracted from assets, the remainder is owners’ equity, or “net worth.” Net worth comes after liabilities both in priority and on the Balance Sheet because owners get paid last. (Welcome to business!)

Net worth is the ultimate score that tells us the cumulative effect of everything that’s happened since the business began.

3. The Statement of Cash Flows - “Where did our cash go?”

I don’t recall ever meeting a small business owner who had even heard of a Statement of Cash Flows, let alone understood it.

It is worth the small effort required to understand because it provides crucial information about the most critical resource in business: Cash.

Cash is critical because most businesses can survive surprisingly long periods without sales or profits, but none can make it past Friday’s payroll without cash.

Like the Income Statement, the Statement of Cash Flows is a period statement. It uses information from the other two reports to tell us where our cash came from and where it went over a specific period of time.

The report answers the question I’ve been asked countless times: “They say I’m making money, so why don’t I have any?”

The report begins with an opening cash balance, shows which activities added cash and which consumed it, and ends with the current cash balance.

The chief benefit of the report is that once we know what’s happening to our cash, we can do something about it. The report is not immediately intuitive, at least not in my experience, but it is not difficult once explained.

Financial statements make management possible

“When you see how useful numbers are for making decisions about the future, you might even begin to enjoy them! ”

Most of us in business use financial statements to provide information about the past, usually to pay our taxes or satisfy our lenders, however, innovative business owners long ago figured out that financial statements can do much more than simply report past performance.

Their highest and best use is to inform our decisions about the future. Explaining how requires the use of a few numbers and a little bit of math, both of which I have promised not to use here.

To see how it works, a great place to start is with my article: “The Most Important Number in Business.” When you see how useful numbers are for making decisions about the future, you might even begin to enjoy them!

How about you?

Can you answer the five questions about your business? Would knowing your numbers be useful? Do you use historic numbers to make informed decisions about the future?

Thank you for reading this article. As always, I value your opinion and welcome your comments and suggestions for future articles in the comment box below.