The Most Important Number in Business

“What would it take to double your profit?” I was talking to Brent, a contractor. We had rearranged his income statement, and his margins were visible for the first time.

“What do you mean?” he asked.

“I mean, based on last year, how much more would you have to sell to double your net profit?”

“I don’t know, probably not double, but something close to that.”

“How about 10.8%?”

“You’re kidding me,” he answered, “ten percent more would have doubled my profit last year?”

“Yep.”

“How do you figure that?”

Applying Margins

Great question. Once we know, we can easily get answers to a lot of interesting and useful questions. Answers to transform guesses into informed decisions and to make a huge impact on profit. All of the questions can be answered by applying the concept of “breakeven” to the most important number in business operations: Margins.

“Margins and breakeven are powerful tools. A former client used breakeven analysis to increase his net profit 808% by reducing sales 37%!”

If you're like a lot of people, you don't like numbers, but hang in there.

Margins and breakeven provide an alternative to the “gut” decisions we have all lived to regret.

We’ll keep the numbers to the minimum necessary to get an idea of how important they are. Once you have the concepts down, your accountant can do the number crunching while you make the decisions.

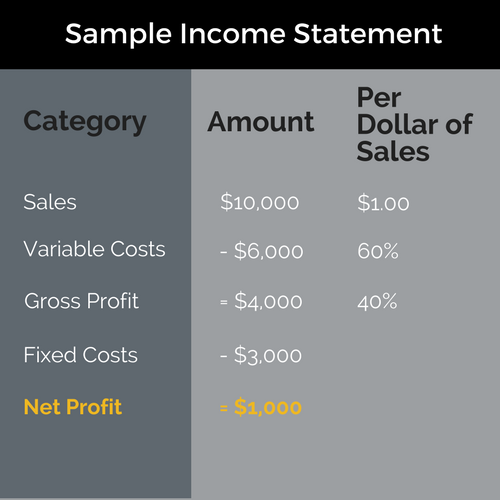

To fully appreciate the power of margins and breakeven, click on the infographic below to clarify a few key concepts.

Our Share of the Sales Dollar

Margins are our share of the sales dollar. If we sell something for $1.00 that cost $.60 to produce, the remaining .40¢is our share. The .40¢is all that remains to pay fixed costs and to accumulate as profit.

Margins are the most important number in business operations because margins enable us to calculate breakeven, which enables us to answer important questions.

Let's use the simple income statement below to answer some common questions:

Important Questions that Margins Answer

How much do I have to sell to start making a profit?

In the example, margins are 40%, which means there is 40¢ of each dollar left to pay overhead and profit. Overhead is $3,000 which, divided by 40¢, shows that it takes $7,500 in sales to break even. The remaining $2,500 in sales times 40¢ accumulates as $1,000 profit.

How much does a salesman have to sell to pay for himself?

If we pay the salesman $5,000 per month, his salary makes up $5,000 of our fixed costs. The $5,000 divided by 40¢ means he has to sell $12,500 per month to break even on his salary.

How much would a new salesman have to sell to pay for himself and hit a target margin?

None of us hire a salesman to just pay for himself. We want him to make us money! Let’s say we want him to pay for himself and make an additional $10,000 margin each month. His total target is now $15,000, which, divided by 40¢, means he has to sell $37,500 each month. (Useful information when setting sales quotas!)

How much more do we have to sell to pay for a new truck?

We’ve got our eyes on a new $60,000 Ford F150 pickup. The price is okay, especially since we can finance it for less than $1,000 per month. But how much do we have to sell to pay for it? Over the lifetime of the truck, we would have to sell $60,000 divided by 40¢, or $150,000 to break even - and that’s before interest, operating and repair costs.

How much more do we have to sell to recover income lost to discounts?

A lot of us use price discounts to attract more customers. When considering a discount strategy, it’s a good idea to know how many more customers we have to attract to break even on the cost of the discounts. This calculation is a little more complex than the others, but if we have a 40% margin and run a 20% discount promotion, our sales have to double just to break even on the discount. (At 35% margins, sales have to increase two and one-third times to recover the cost of a 20% discount.)

How much less could we sell if we raised our prices?

Most of us are scared to raise prices because we’re afraid of losing sales. When considering a price increase, it’s useful to know how many sales we could lose before higher prices affect our gross profit. Again, this is a more complex calculation, but if we have 40% margins and raise prices by 20%, we can lose 33% of our sales and keep the same gross profit. Bummer. We’d be making the same money working one third less.

Download a free discount calculator to see how much more you have to sell if you lower your prices and a free price increase calculator to see how much less you have to sell if you raise them.

How Do You Figure That?

Now to Brent’s question: Based on last year, how much more would he have to sell to double his net profit? For this one, we’ll use his actual income statement. The target was to double his $160,000 net profit. How did I know a 10.8% increase in sales would do it? The P&L looked like this:

Per dollar of sales

Sales $3,700,000 $1.00

Variable costs - 2,220,000 60%

Gross profit = 1,480,000 40%

Fixed costs - 1,320,000

Net profit = 160,000

Brent was past breakeven, which meant margins from new sales would accumulate entirely as profit. To see what it would take, I divided $160,000 by 40¢ to get $400,000, which is 10.8% of his original $3.7 million sales.

Is There Another Way?

When we start thinking about margins, we find all sorts of uses for them.

For example, what would happen if Brent increased his margins from 40% to 45%?

His sales of $3.7 million times 5% means he would generate an additional $185,000 gross profit on the same sales. The entire $185,000 would flow to the bottom line, more than doubling his net profit! What if he could raise sales 10.8% and increase margins 5%? His net profit would rise to $525,000, or 3.25 times.

How Do You Increase Margins?

By paying attention to them.

By doing a better job controlling freight costs, credit card charges, purchase quantity discounts, sales commissions, inventory levels, discounts, price decisions, scheduling and so on.

Every one of us can improve margins once we realize how important they are.”

The above are just a few examples of the many ways margins and breakeven help make informed decisions. There are many more. Every business decision has a cost or target component, and every cost or target has a breakeven. We become a “walking around breakeven calculator” who can make informed decisions quickly on virtually any business question by knowing one number, margins.

To put margins and breakeven to use, we have to:

Separate our variable and fixed costs

Calculate our margins as a percentage of sales

Divide our target amount by margins to find to breakeven or hit a target

If that sounds tedious, get a good accountant to do it for you. Our job is not to compile numbers, but rather to use the information to make better business decisions.

Was this article useful? Could you sell 10.8% more if you knew it would double your profit? Have you ever wondered how to make informed business decisions? As always, I appreciate your questions and feedback in the comment box below. If you’d like a copy of the tables showing the effects of discounts and price increases on breakeven and profit, just ask and I’ll send one to you.

*Variable costs are also known as direct costs, cost of goods sold, and cost of sales.

**Fixed costs are also called overhead or indirect costs.